Mike Khouw, Optimize Advisors president, joins CNBC’s Melissa Lee and the Options Action traders to talk a bullish bet in the …

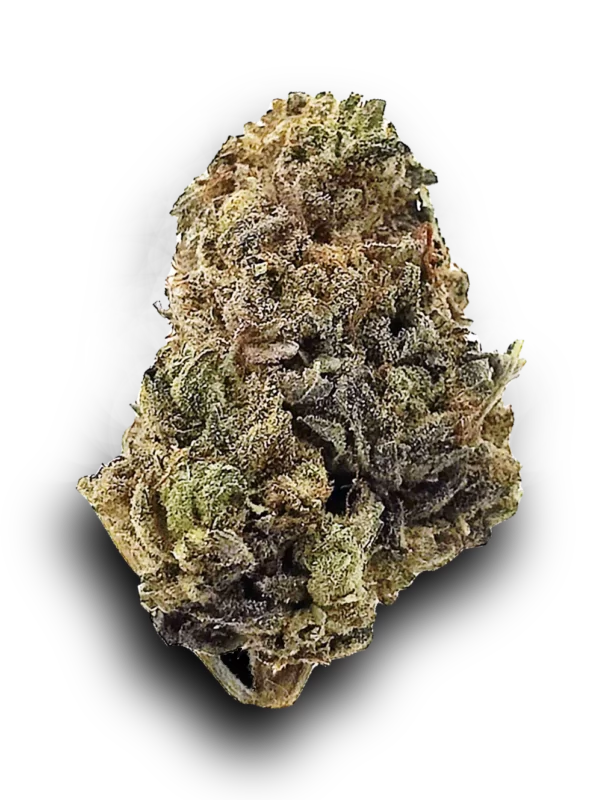

In a recent episode of “Options Action,” the show’s traders discussed a bold bet placed on a cannabis exchange-traded fund (ETF) called MJ. The trader made a bullish wager, betting that the ETF would reach $10 by January. The MJ ETF has been exhibiting signs of strength lately, with the potential for favorable outcomes due to the upcoming U.S. elections and increasing acceptance of cannabis. The trade involved buying call options with a strike price of $10, implying that if the ETF surpassed $10 by January, the trader would profit from the trade. However, should the ETF fail to reach that level, the trader risks losing the premium paid for the options. Despite the inherent uncertainty in the cannabis sector, the trader’s bullish wager reflects their optimism surrounding the cannabis industry, particularly driven by potential legislative changes and its expanding market.

source

GET LATEST CLUB WEED DEALS

GET LATEST CLUB WEED DEALS